new hampshire sales tax on vehicles

Although walk-in services are available customers with an appointment will be given priority. Motor Vehicle Hearings have resumed in-person hearings or you may elect to appear by telephone or video conference by calling 603 271-2486 or emailing safety-hearingsdosnhgov before the day of the hearing to provide contact information.

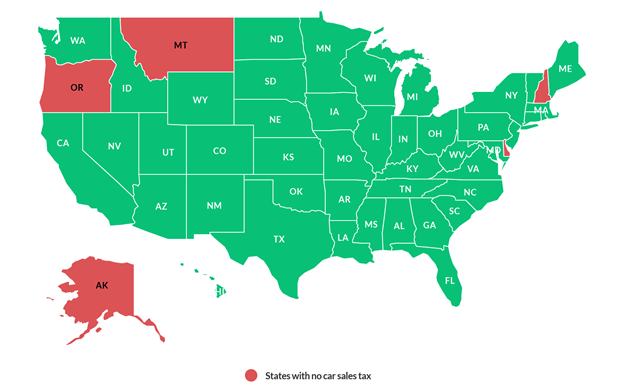

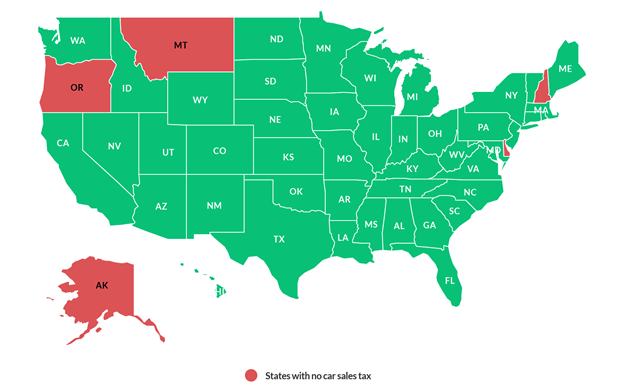

What S The Car Sales Tax In Each State Find The Best Car Price

The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

. The NH sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt. Does New Hampshire have sales tax on cars.

However vendors in New Hampshire must register for other states sales taxes and. The tax is due on the 15th of the month following the month taxes were. The fee is 10.

Exemptions to the New Hampshire sales tax will vary by state. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions.

The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. Ad Find Out Sales Tax Rates For Free. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. Motor vehicle rental tax. The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax.

Taxes on the self-employed above a certain threshold by 2021 the business profits tax will be 75 and the business enterprise tax will be 5. New Hampshire has a 0 statewide sales tax rate and does not allow local. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Only a few narrow classes of goods and services are taxed eg. New Hampshire may not have a car sales tax rate but there are still additional fees to be aware of.

Customs upon entry into New Hampshire. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. A 9 tax is also assessed on motor vehicle rentals.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax.

For example if you purchased a motor vehicle in New Hampshire on January 1st and brought it into Massachusetts on June 30th a use tax would be due by July 20th. Answer 1 of 3. What is the tax on a new car in New Hampshire.

New Hampshire does not have a sales tax on sales of goods in the state. A 7 tax on phone services also exists in NH. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. Whilst tourists save money on shopping because of the 0 sales tax on goods purchased in stores they will pay more for the services above. Prepared meals hotel rooms cigarettes motor fuels medical services thats all thats coming to mind off-hand.

New Hampshires sales tax rates for commonly exempted items are as follows. However you must complete the EPA Declaration Form Importation of Motor Vehicles and Motor Vehicle Engines Subject to Federal Air Pollution Regulations Form 3520-1 making sure you declare code M on it and hand this to US. You will also need to provide proof that the vehicle was acquired via.

What states have the highest sales tax on new cars. States with high tax. Fast Easy Tax Solutions.

Any motor vehicle rental business must collect a 9-percent excise tax on vehicle rentals. Exemptions Transfer by contest. The registration fee decreases for each year old the vehicle is.

Towns are permitted to charge 1800 per 100000 of the vehicles MSRP rounded off to the nearest 100. Heres how the additional costs associated with car purchases in New Hampshire pan out. If you purchase a used Honda Civic for 10000 you will have to pay an.

No there is no sales tax. If you are legally able to avoid paying sales tax for a car it will save you some money. These costs include the registration fee title fee license plate transfer and documentation fee charged by most dealerships.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. For example a 2020 vehicle that costs 20000 would cost 300 for new registration. I traded a car for another car and now I cant register the car that I got New Hampshire 3 replies Property Taxes and other taxes New Hampshire 23 replies Paying taxes in NH New Hampshire 14 replies Insurance Cost of Living Taxes Car Inspections New Hampshire 19 replies Questionable value for your property taxes New Hampshire 11.

The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more. However if you go to tr. If the RMV has issued a motor vehicle title to the seller as a salvage vehicle the sales or use tax is based on on the actual sales price.

Are there states with little to no sales tax on new cars. New Hampshire DMV Registration Fees. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

The tax is due on gross receipts that exceed 222000 or if the Enterprise Value Tax Base is greater than 111000. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a. For example sales tax in California is 725.

There is no sales tax at all in New Hampshire but there is a registration permit tax that is collected by towns in the state on new vehicles. 18 per thousand for the current model year 15 per thousand for the prior model year.

We Issued 14 000 Free Warnings In July

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

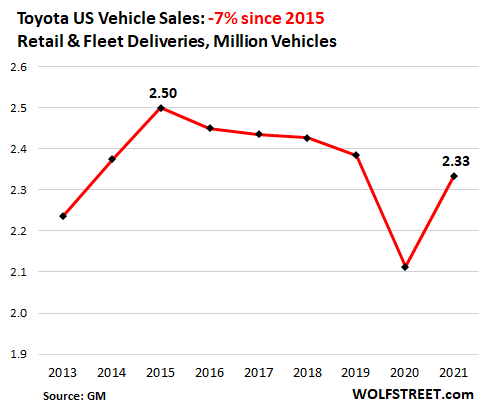

New Vehicle Sales In 2021 At 1978 Level 25 Years Of Stagnation Interrupted By Plunges But Prices Explode To Wtf Level Wolf Street

Rows Of New Cars Hi Res Stock Photography And Images Alamy

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Pin On Transportation Infographics

Is Buying A Car Tax Deductible In 2022

Eco 201 Microeconomics Milestone 2 Milestones What Type Online University

Car Tax By State Usa Manual Car Sales Tax Calculator

A Complete Guide On Car Sales Tax By State Shift

Nj Car Sales Tax Everything You Need To Know

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Is Buying A Car Tax Deductible Lendingtree

6 Steps To Follow When Taking Delivery Of Your New Car Cardigest Ca

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Channeling The Spirit Of Buford T Justice An Ad For The 1977 Pontiac Lemans With Police Enforcer Package 300th Pin For T Pontiac Lemans Pontiac Police Cars

Should You Lease Or Buy Your Next Vehicle Check Out This Graphic To Help You With Your Decision Your Shield Of Car Care Tips Cheap Car Insurance Car Facts